SAP and the Cloud Transformation: Structural Drivers and Opportunities for Partners

Volpi has engaged with over 30 European SAP partners since 2024 and we see significant value creation opportunities in the ecosystem.

SAP is entrenched as the dominant enterprise platform, with over 400,000 customers in 180 countries, and an unrivalled presence in Europe and core global industries. Nearly 92% of the Forbes Global 2000 and 90+ of the world’s largest 100 companies use SAP.

Partners are at the heart of SAP’s go-to-market model: 25,000+ partner organisations in 140 countries drive 80% of new customer wins and 90% of implementations. SAP’s evolution from an on-premise ERP provider to a cloud-driven platform presents a profound opportunity for partners, which are benefitting from the favourable structural dynamics in the ecosystem:

The Cloud Transition: Stick and Carrot

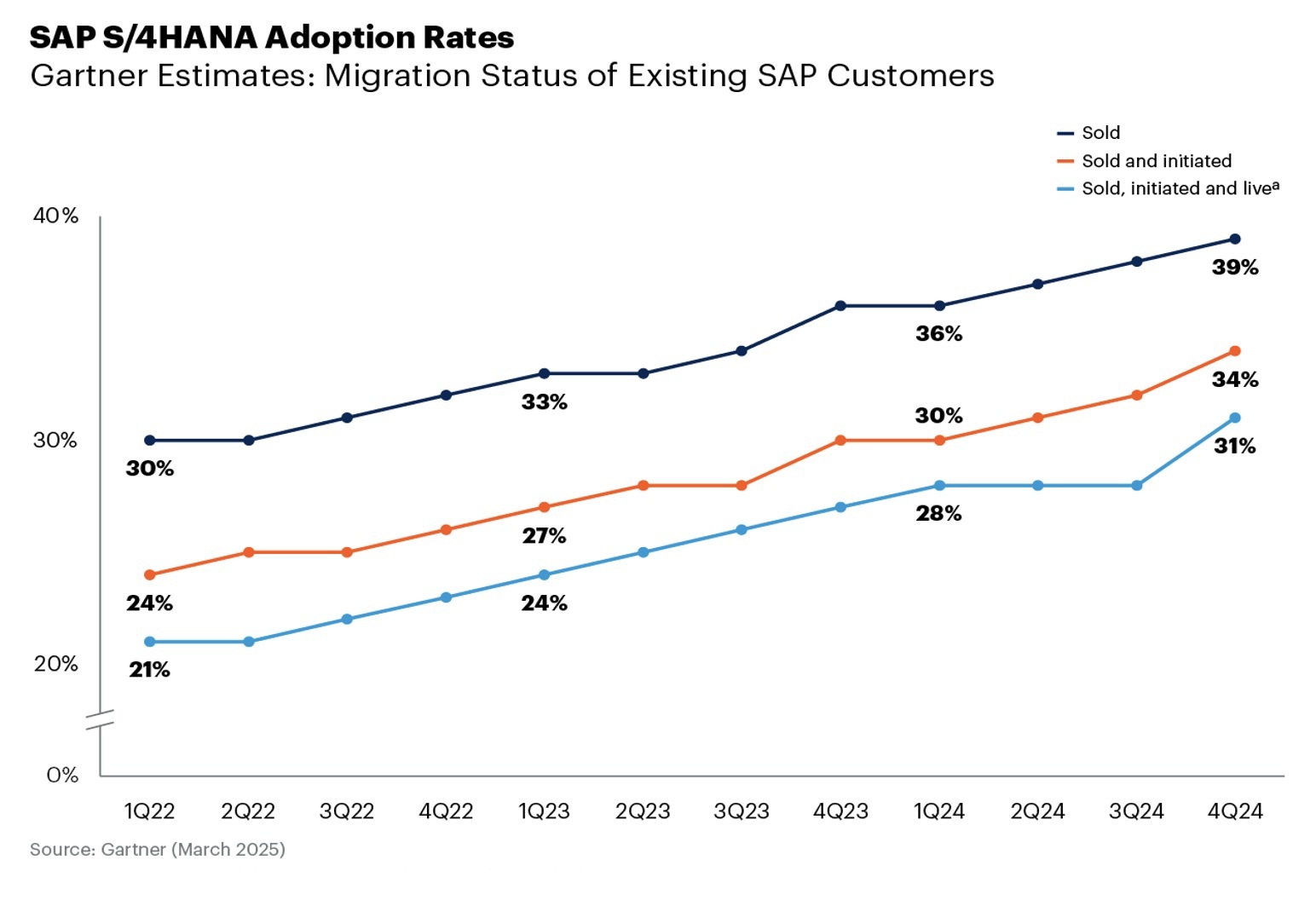

The SAP cloud transition remains a “stick and carrot” story: maintenance deadlines (notably 2027/2030) and the phasing out on-prem support have been forcing customers to migrate from ECC over the last few years, albeit at a slower pace than SAP would have liked. Whilst SAP’s cloud transformation has continued to gain momentum, with cloud revenue reaching €17.14 billion in 2024—a 25% year-over-year increase—and projections targeting €21.6-21.9 billion for 2025 – it is the cloud-only functionality (particularly in AI) that is rapidly becoming the key pull for customers to migrate. By Q1 2025, about 50% of SAP cloud orders included an AI component, largely driven by Joule. The Q2 2025 results showed sustained 24% cloud growth, supported by a €18.2 billion cloud backlog that grew 28% year on year, evidencing that SAPs “cloud-only” strategy around major new innovations— particularly Joule and cloud-exclusive AI features – are giving customers a new “carrot” to accelerate their migration timelines.

Yet the scale of remaining opportunity is remarkable: only approximately 40% of SAP’s core ERP customers have completed or started their S/4HANA cloud migration, while HCM transitions are further along at roughly 80% completion. 77% of S/4HANA migrations are partner-led, creating a significant addressable market for partners specializing in migration services, data integration, and cloud optimization.

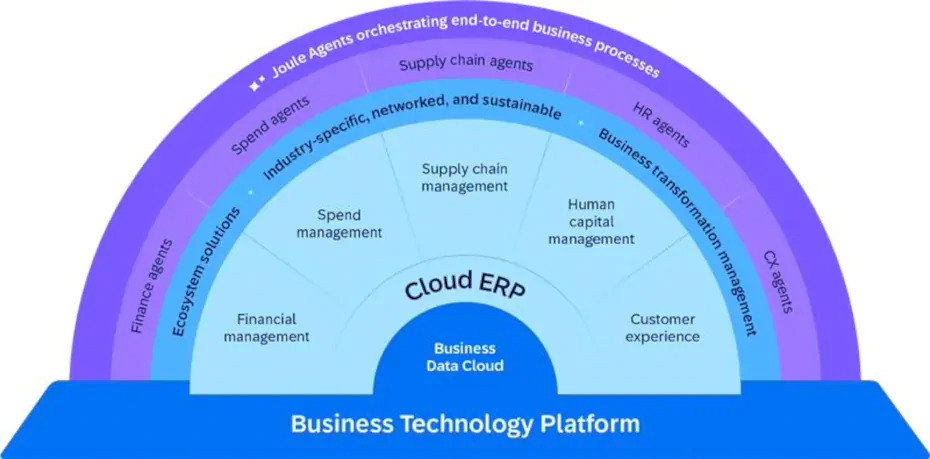

SAP Business Suite: cross-suite capabilities & consolidation

SAP’s multi-year transition to “Suite First, AI First” is bringing together ERP, HCM, CX, supply chain, spend and financial management—increasingly unified on the cloud – and has created a fundamental change in the ecosystem. While historically separate on-premise products had their respective solution-focused partners, the cloud transition now demands partner-to-partner collaboration across geographies and specialisms.

For partners, this creates an opportunity to move beyond traditional point implementations and to deliver comprehensive solutions across ERP, HCM, CX, and supply chain management. 45%+ of cloud customers use multiple SAP products; 20% use four or more.

However, few partners, even in the large segment, have true cross-suite capability. As a result, consolidation opportunities are emerging, especially in the European mid-market, for building both “full-suite” partners and deep specialists in regulated or technically demanding verticals.

IP Development in Cloud Environment

Services revenue continues to be dominant, but the mix is tilting towards partners delivering proprietary intellectual property (IP), data connectors, industry-specific solutions, and complex integrations. Volpi’s analysis points to three partner types experiencing above-average growth and margin:

- Sector-focused ISVs enhancing core SAP platforms: The cloud “clean core” approach enables partners to build side-by-side extensions without disrupting SAP’s core functionality. Furthermore, customizations previously built in ABAP or ECC can now be refactored as BTP extensions and add-ons, then commercialized globally through the SAP store, transforming partners from project-based consultants to recurring revenue software vendors by allowing them to package their unique domain expertise into reusable, scalable solutions. On average, partners generate $8.81 for every $1 of SAP revenue, whilst partners offering product/IP-led solutions generate >$10.

- Providers of accelerators: Partners developing accelerators for implementations, migrations, and optimizations address SAP’s persistent challenge: making cloud transitions faster, less costly, and less painful for customers. Accelerator partners are shifting from time-and-materials billing to value-based, packaged pricing models. They build reusable IP assets (methodologies, automation tools, pre-configured templates) that can be deployed across multiple client implementations, driving both speed and margin improvement.

- Data-focused partners: SAP’s Business Technology Platform (BTP) and new integrations (e.g the recently announced Databricks partnership) are meant to solve persistent data fragmentation and unlock unified analytics, but these are work-in-progress. Partners developing connectors, data migration solutions, or embedded analytics play a pivotal role in helping customers realise the value of their cloud journey – and can generate margins of 40%+.

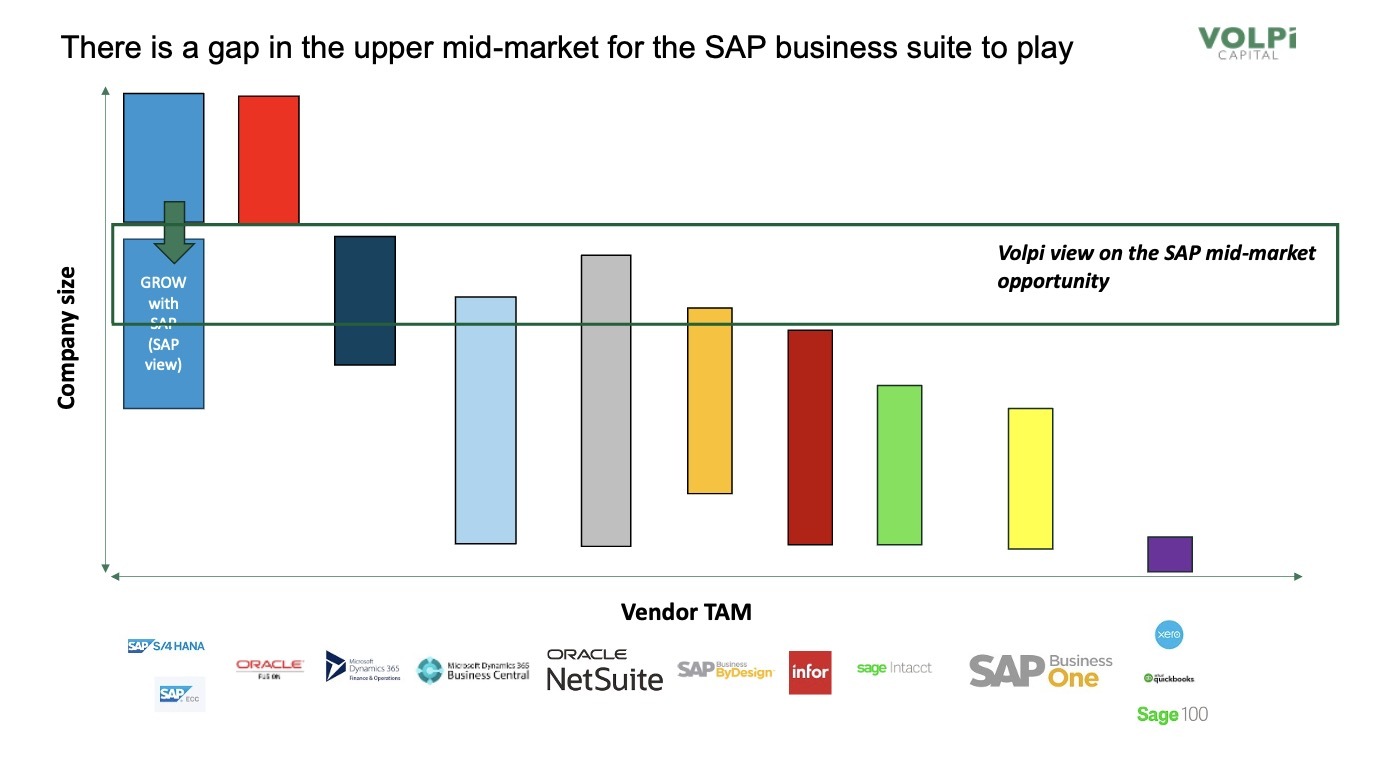

The Mid-Market opportunity: Strategic Importance for SAP

The mid-market segment — typically comprised of companies with €200m–€1.5bn turnover — is increasingly strategic for SAP as it looks to sustain 25–30% annual cloud growth in the coming years.

It represents a vast pool of net‑new logos for the GROW with SAP programme but winning them requires more than “full‑fat” S/4HANA, which in its present form is often too costly and too large for the mid-market.

Notably, SAP recognises that success in this space cannot be achieved directly. The mid-market is highly fragmented across sectors and geographies, and customers demand faster, lower‑cost deployments, verticalized functionality, and integration with existing tools. Conversations with SAP leadership confirm that partners who can successfully drive net-new customer acquisition and foster cloud adoption in the mid-market are set to receive enhanced support from SAP – including greater access to channel resources, training, go-to-market funding, and technical enablement.

The Need for Next-Gen SAP Partners of Scale

SAP’s continued evolution — uniting its full Business Suite under a common architecture, pushing deeper into the upper mid‑market, and accelerating its cloud transition — cannot be achieved without a capable, innovative partner ecosystem. The scale and complexity of these ambitions demand partners that can operate across geographies, deliver cross‑suite capability, and differentiate through proprietary IP, accelerators, and data integration expertise.

For entrepreneurial SAP partners, this creates both opportunity and urgency. As SAP shifts to “cloud‑first” delivery and seeks deeper vertical penetration, those with the vision and capacity to extend the platform, shorten implementation timelines, and solve mid‑market challenges will be in highest demand.

Private equity can be the catalyst for that next stage of growth — helping partners professionalise, broaden geographic reach, invest in product development, and build recurring revenue streams. In a market where scaled, IP‑rich SAP partners are scarce and command premium valuations, those that move decisively now are best positioned to become the next generation of leaders in SAP’s global ecosystem.

We’d Love to Hear from You

If you are an SAP partner, ISV, or entrepreneur interested in building the next-gen SAP pan-European champion—or simply want to share your perspective—we’d love to hear from you.